Gestamp, multinational specialized in the design, development and manufacture of highly engineered metal components for the automotive industry, presented today its results for the first quarter of 2025, maintaining its profitability after achieving €2,983 million of revenues, despite the lack of market growth and negative currency impact.

Francisco J. Riberas, Executive Chairman of Gestamp: "Despite the context of high uncertainty, volatility and limited market growth, where volumes for 2025 are difficult to predict, we reiterate our guidance, as our business model adapts well to the current market environment and we are executing a plan to preserve our financial strength and mitigate potential impacts".

Strong financial profile in a challenging environment

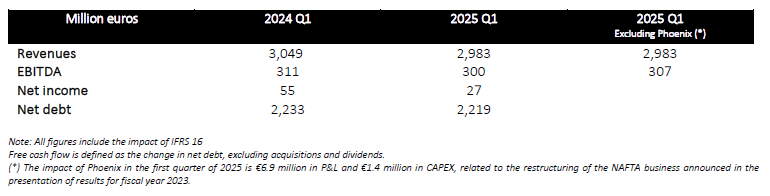

From January to March 2025, Gestamp reached revenues of €2,983 million. These figures are achieved despite the current automotive industry transition context, with short-term uncertainty outlook due to volatility in some of the key markets where Gestamp operates.

In this scenario, Gestamp continues to strengthen its financial profile in order to protect its positioning in a market environment with lower production volumes, following the geographical, client and product diversification strategy, as well as the implementation of short-term initiatives including a cost control plan and flexibility measures to ensure efficiency. EBITDA between January and March amounted to €307 million (excluding the impact of the Phoenix Plan) and an EBITDA margin of 10.3%, which allows the company to maintain its profitability and financial strength at a time of high volatility in the sector.

Free cash flow improved compared to the first quarter of last year, standing at €-74 million (excluding the impact of the Phoenix Plan), versus €-131 million in the first quarter of 2024. Due to this, Gestamp’s net debt stood at €2,219 million, which represents a leverage of 1.7x net debt to EBITDA, the lowest nominal debt achieved by the company in the first quarter since the implementation of International Financial Reporting Standard 16 (IFRS 16).

Phoenix Plan in NAFTA

Phoenix Plan in NAFTA

One of the company's main priorities remains the execution of the Phoenix Plan in NAFTA. Despite the quarterly performance, marked by a decrease in production volumes of light vehicles in the United States, the plan develops as foreseen and an EBITDA margin of approximately 8% by the end of 2025 should be expected.

The plan remains on track, in line with its objective of increasing the profitability of NAFTA to the same levels as the rest of the regions where the company is present.

2025: Focus on preserving financial strength

These results are in line with the guidance set for 2025 and reflect an adaptable business model that responds to a challenging and uncertain environment, thanks to Gestamp’s strategy of geographical, client and technological diversification. The company reiterates its commitment to meet the guidance set for 2025, growing above the market in a low-single digit range and preserving the profitability of the automotive business in line with 2024, maintain a leverage level and a free cash flow in the range of that achieved in 2024. In the case of Gescrap, 2025 will be in line with the previous year.

To achieve this, Gestamp remains committed to a sustainable balance between growth, profitability and investments. The company pursues a plan to preserve profitability and its financial strength, supported by cost control measures, a strict CAPEX strategy focused on return on investment and efficient working capital management. Altogether with the aim of ensuring short-term competitiveness, long-term balance finance strength and consolidating its position on the market.

General Shareholders’ Meeting: Commitment to Shareholder Returns

Gestamp held today its Shareholders' Meeting during which the 2024 Consolidated and Individual Accounts were approved, as well as the distribution in July of an additional dividend of €0,0511 gross per share in line with the company’s commitment to generate value for shareholders. The total dividend payment was €0.1 gross per share, fulfilling our commitment announced in the CMD of a 30% consolidated net profit payout for the year.

In addition, the Shareholders’ Meeting approved the appointment of Patricia Riberas as member of the Board of Directors of Gestamp as an Executive Director.

In 2025, Gonzalo Urquijo will leave his position on the Board of Directors of Gestamp. Mr. Urquijo was appointed External Director as on March 24, 2017 and has since held various positions within the Board, always contributing with his valuable experience and strategic vision. Gestamp, through its Executive Chairman, Francisco J. Riberas, would like to express his gratitude to Gonzalo Urquijo for his years of dedication and the important contribution made to the company during this time.

In addition, the company announces that Patricia Riberas has been appointed Chief Corporate Officer, assuming responsibilities for innovation, sustainability, operational excellence, industry 4.0, transformation and information technologies. Patrica Riberas started her career at Gestamp in 2018 as Director of Sales and Marketing Controlling. In 2021 she was appointed Director of Transformation and, to date, served as Director of Operational Excellence.