Gestamp, a multinational specialized in the design, development, and manufacture of highly engineered metal components for the automotive industry, has presented its results for the third quarter of 2025. From January to September, the company has improved its profitability despite the challenging automotive sector environment and the adverse impact of foreign exchange rates. Gestamp has achieved a leverage of 1.6x net debt to EBITDA as of September 2025 and reported the lowest net debt in the first nine months since IPO.

Francisco J. Riberas, Executive Chairman of Gestamp said: “We are facing a complex market environment driven by regulatory uncertainties and volatility in production volumes. Our focus is to maintain and strengthen our capital structure in an industry undergoing a profound transformation, improving profitability through rigorous operational efficiency and strict cost control, while optimizing indebtedness to strengthen our balance sheet.”

Enhanced financial strength

In the third quarter, Gestamp completed a new senior bond issuance due in 2030, providing balance sheet flexibility and further strengthening the company’s capital structure by extending the average maturity of its liabilities at a competitive cost. Additionally, as announced in July, the multinational closed the agreement with the Santander Bank’s investment entity, Andrómeda Principal Investments, S.L.U., to acquire a minority stake in four subsidiaries owners of Gestamp’s real estate assets in Spain for €246 million.

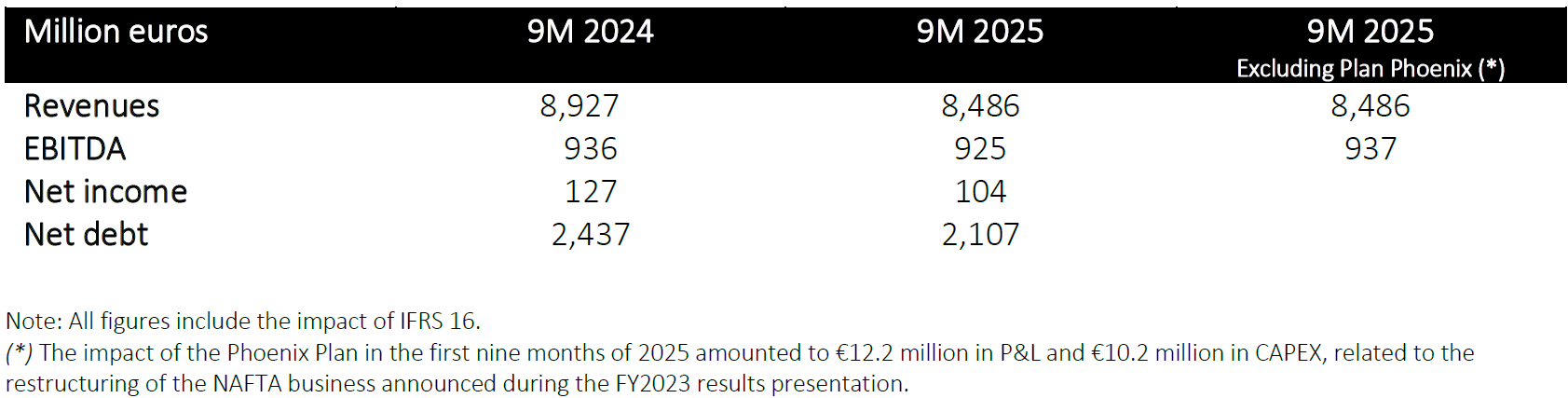

Both transactions, aligned with the company’s strategic objectives, aim to strengthen the balance sheet and crystalize assets value. The direct impact on financial results has been a reduction of the net debt to €2,107 million in Q3 2025 compared to €2,437 million in the same period of 2024, which represent a leverage of 1.6x net debt to EBITDA—the lowest achieved by Gestamp in the first nine months of the year since IPO.

These results have been achieved in a complex environment for an industry undergoing a fast and in-depth transformation, characterized by volatility in production volumes, tariff pressures, and regulatory uncertainty. In this context, the company closed the first nine months of the year with revenues of €8,486 million, affected by the negative impact of foreign exchange rates.

Despite this context, Gestamp continues to preserve and improve profitability by implementing short-term initiatives, including flexibility measures and a cost control plan to ensure efficiency. As a result, EBITDA in the first nine months of the year amounted to €937 million (excluding the impact of the Phoenix Plan) and an EBITDA margin of 11%.

The Phoenix Plan in NAFTA: a strategic priority

The Phoenix Plan in NAFTA: a strategic priority

The light vehicle production volumes grew by 4.3% year-on-year, mainly driven by Asia, despite a significant decrease in Europe and NAFTA. The latter remains a strategic market for the company, where it is executing a three-year plan to increase profitability to the same levels as in the rest of the region where the company is present.

Despite a 1% decline in light vehicle production volumes in the NAFTA region from January to September 2025, the plan develops as foreseen, with an EBITDA margin of 7.6% at the end of the third quarter (excluding the impact of the Phoenix Plan) and is expected to close the year with an 8% EBITDA margin and reach double-digit levels in 2026.

Guidance in line with expectations

In the current context of high uncertainty and limited market growth, Gestamp has made an update to its guidance for the end of 2025. The multinational expects a slight improvement in automotive business profitability compared with year-end 2024. To further consolidate its financial strength for another year, Gestamp expects to generate a free cash flow in line with 2024 and improve its year-end leverage level (1.6x net debt to EBITDA, excluding the impact of the Phoenix Plan).