Gestamp, the multinational specialized in the design, development and manufacture of highly engineered metal components for the automotive industry, presented today its results for 2024, with revenues of €12,001 million and EBITDA of €1,319 million. Figures in line with the targets set, despite the complexity of the automotive market, characterized in this period by unprecedented volatility.

Francisco J. Riberas, Executive Chairman of Gestamp: “Despite having faced one of the most adverse environments in recent years as a sector, the results achieved in 2024 once again demonstrate our financial strength, as well as the success of our business model in adapting to a demanding and uncertain environment, in which vehicle production volumes continue to decline. In fact, we closed the year preserving our balance sheet strength, with financial discipline as we have been doing since our IPO (2017)”.

Regarding the outlook for 2025, the Executive Chairman pointed out that “within a context of high uncertainty, volatility and limited market growth, we need to return to out long-established business fundamentals and pursue further value creation opportunities by leading changes that will drive us to succeed in the industry transformation”.

2024 has been characterized by light vehicle production volumes reaching 89.4 million vehicles, a drop of 1.1% compared to the previous year. Specifically, at the end of 2024 the vehicle production volumes were at pre-pandemic levels (2019), when 89 million vehicles were reached.

Financial strength in a complex environment

In 2024, Gestamp continues to reinforce its financial strength to protect its positioning in a market environment with lower production volumes, a priority it has had since its IPO in 2017. In fact, comparing the 2024 results with 2017, Gestamp has increased its revenues thanks to its geographic and technological diversification and has reduced its net debt with a clear focus on generating positive free cash flow.

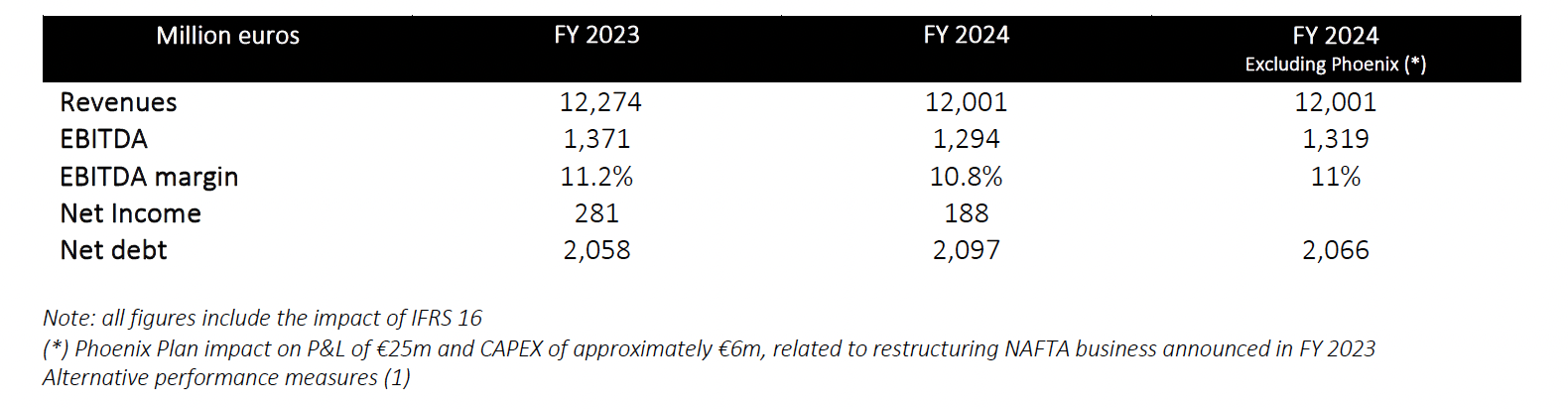

Gestamp's revenue in 2024 stood at €12,001 million, despite the negative currency fluctuations and the slowdown in global vehicle production. The company closed the year with above-market growth, outperforming the market by 4.5 percentage points (at FX constant), driven by geographic diversification, product differentiation and a strategy based on innovation.

EBITDA, between January and December, amounted to €1,319 million euros (excluding the impact of the Phoenix Plan) and an EBITDA margin of 11%, allowing the company to maintain its profitability and financial strength in a context of volatility in the automotive sector.

In line with the established forecasts, free cash flow improved in the last quarter of the year, generating a positive balance closing in 2024, with €134 million euros (excluding the impact of the Phoenix Plan), despite negative currency fluctuations. Thanks to this positive free cash flow, Gestamp's debt stood at €2,097 million euros, which represents a leverage of 1.6x net debt to EBITDA, one of the lowest ratios achieved by the company since its IPO.

Electric vehicle sales remain stable

Electric vehicle sales remain stable

Electric vehicle production in 2024 was slower than expected through the year due to market volatility, especially in Western Europe and NAFTA, key regions for Gestamp in electric vehicle. Even so, the group's sales of electric vehicle-related components remained stable at 20%, in line with the percentage achieved last year.

In this context, the multinational will continue to develop innovation strategies to anticipate unique solutions to make the trend towards sustainable mobility a growing reality in all regions where Gestamp is present.

Phoenix Plan: a step towards reaching the targets

One of the company's main priorities is the execution of NAFTA's Phoenix Plan. In this regard, the plan continued on track, confirming the planned objectives after reporting an EBITDA margin of 7% at the end of 2024, compared to 6.7% a year ago. Following this performance, Gestamp maintains its goal of bringing the EBITDA margin in this region to double-digit by 2026, in line with the profitability of the rest of its geographies.

Gestamp in 2025

Despite unprecedented volatility and uncertainty in the speed of electric vehicles penetration in key regions, the light vehicle production forecast for 2025 is expected to remain stable at around 89.0 million vehicles in line with 2024.

In this context, Gestamp faces 2025 with the aim of growing above the market in a low-single digit range and preserving the profitability of the automotive business in line with 2024. For Gescrap, 2025 will be in line with the previous year.

In its commitment to preserve balance sheet strength, Gestamp will generate positive free cash flow through the implementation of operational improvements, which will minimize the impact of lower vehicle production volumes that will continue to affect the market worldwide. Likewise, in 2025 it will maintain a leverage level in the range of that achieved in 2024, which has been one of the lowest ratios since its IPO.

Gestamp has achieved a solid order backlog for the next five years of up to 51.1 billion euros, a figure that underpins revenue targets for the 2025-2029 period.

By 2025, Gestamp will be committed to maintain a well-balanced equilibrium between growth, profitability and CAPEX, with a cost control plan, a CAPEX strategy focused on return on investment and an efficient working capital management to preserve short-term competitiveness, long-term balance sheet strength and market positioning.

With a focus on preserving its financial strength and improving competitiveness, Gestamp has redefined its CAPEX strategy through a series of levers based on the rationalization of current investments, focusing on future investments in high-growth regions and technologies, and a review of its investment criteria to ensure a return on capital.

Progressively, the impact of this strategy will be reflected in the coming years.