Gestamp, a multinational specialized in the design, development and manufacture of highly engineered metal components for the automotive industry, today presented its financial results for the first quarter of 2023. The figures show the resilience of the business model.

Francisco J. Riberas, Executive Chairman of Gestamp: “During this first quarter we have delivered strong growth thanks to our solid competitive positioning based on an innovative product portfolio, our proprietary technologies and a well diverse geographic footprint which allows us to be close to our client needs. Despite an adverse backdrop of inflation and raising interest rates, our focus continues to be on delivering growth, cost control and financial discipline to meet our guidance for the year.”

From January to March 2023, the automotive market has shown strong dynamism. Auto production has grown by 5.7% according to the data published by IHS in April.

Compared to 19.9 million vehicles produced in the first quarter of 2022, the same period of 2023 registered a production of 21.1 million vehicles. However, figures are still below the level of production achieved during the first three months of 2019. Western Europe and NAFTA have lead growth during the period.

Record quarter for Gestamp1

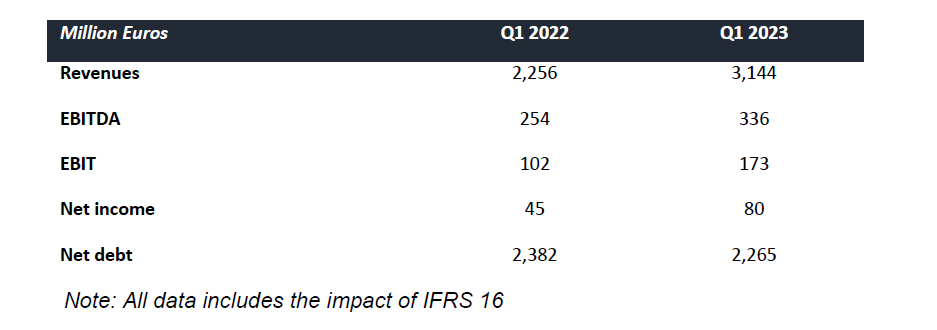

Gestamp's revenues during the period grew by 39.4% to reach €3,144 million, a record figure for Gestamp in a single quarter. Revenues include a €163 million contribution from Gescrap (full consolidation), which was acquired in December 2022 to position Gestamp on the circular economy opportunity.

During this first quarter, Gestamp organic revenues (excluding Gescrap) have increased by 32.1% implying an outperformance of 27.5 percentage points or 22.7% if we exclude the mark up from recent raw material price increase. This strong outperformance proves our strategic positioning, our differentiated business portfolio and the strength of our client relationship.

EBITDA stood at €336 million, an increase of 32.7%, with EBIT reaching €173 million, a 70.5% increase. As for net profit, it reached €80 million, an all-time high in a quarter since Gestamp is listed.

The company has invested in the period 6.5% of revenues with over 75% of the growth capital expenditure related to Electric Vehicle.

Strong balance sheet position acknowledged by the market

Gestamp has closed this first quarter with a net debt of €2,265 million, implying a leverage of 1.8x net debt to EBITDA. Since September 2022 Gestamp has kept its leverage below 2x EBITDA, meeting its IPO commitment as a result of our financial policy.

This policy based on consistently improving organic free cash flow generation and deleveraging has been acknowledged by the market. S&P has recently upgraded our corporate rating from “BB-“ to “BB” with stable outlook.

Successfully company refinancing

Also, Gestamp has taken a step beyond in its financial profile and it has successfully executed the refinancing of its €1,200 million which groups the syndicated credit facility and some bilateral loans. According to the new terms, Gestamp has extended the average lifetime of its debt to more than 5 years.

With this new maturity scheme and considering our total liquidity position of €2.3 billion, Gestamp faces the next years with a comfortable balance sheet structure. The deal has been agreed with 17 banks, with an oversubscription of 30%.

Shareholders meeting: dividend approval and presentation of ESG Strategic Plan

Today, Gestamp has held its general shareholders meeting where the Individual and Consolidated Accounts of Gestamp Automoción corresponding to the year ended December 31, 2022 have been approved. The approval of final dividend of €0,074 per share has been confirmed. As a result, the total dividend payment against 2022 results amounts to €0, 14 per share representing a 67% increase compared to last year.

Additionally, this year the new ESG Strategic Plan to 2025 has been presented. This strategic plan is a step further in the trajectory maintained since the beginning of Gestamp’s activity. This new ESG Strategic Plan to 2025 is aligned with the priority of the Company to contribute, in these times of transition, to the decarbonisation of the sector and the company’s commitment to the circular economy.

1This press release (the "Press Release"), in addition to financial information detailed in the Gestamp Group´s financial statements prepared in accordance with International Financial Reporting Standards, contains alternative performance measures ("APMs") as defined in the Guidelines on Alternative Performance Measures published by the European Securities and Markets Authority (ESMA) on October 5, 2015.

A breakdown of the explanations, definitions and reconciliations of the APMs used in the Press Release can be found, as applicable, in Note 4.6. of the Notes to the Consolidated Financial Statements of the Gestamp Group as of December 31, 2022, in the Management Report of the Gestamp Group corresponding to the first quarter of 2023 as well as in the relevant results presentation, available both on Gestamp's corporate website (https://gestamp.com/Investors-Shareholders/Economic-Financial-information) and on the website of the National Securities Market Commission (Comisión Nacional del Mercado de Valores) (www.cnmv.es).