Gestamp, a multinational specialized in the design, development and manufacture of highly engineered metal components for the automotive industry, today presented its results for the first nine months of 2022.

Francisco J. Riberas, Executive Chairman of Gestamp: "Our results continue to reflect Gestamp's strong positioning and the success of our strategy. Looking ahead market conditions remain difficult due to high inflationary pressures, rising interest rates and global geopolitical challenges. In this context the Company will continue focusing on preserving profitability and its balance sheet position for future growth”.

According to IHS there has been a globally increase in terms of production volumes during the quarter up to 19 million (Gestamp geographies), which is 27% higher YoY. The Company has, once again, outperformed market growth thanks to its strong positioning.

Financial Results

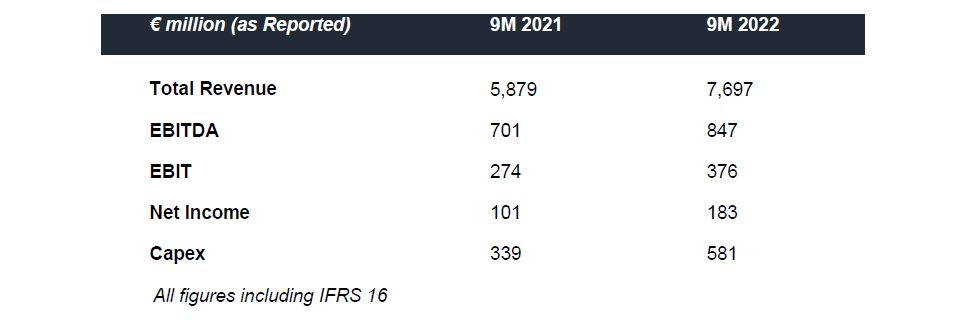

During 9M 2022, Revenues increased by 30.9% in reported terms during the period, reaching €7,697 million. EBITDA stood at €847 million, thus registering an increase of 20.9% compared to the first nine months of 2021. Regarding profitability and liquidity, EBITDA margin stood at 11% (12.4% excluding raw material impact) in the period and the Company generated a free cash flow of €65 million July to September. On the other hand, Gestamp recorded a net profit of €183 million in 9M.

Investments have reached levels of 7.5% of revenues for the period, €581 million in absolute terms. As the company is focused on electrification trends, over 50% of 9M 2022 tangible capex is related to Electric Vehicle.

Net Debt stands at €2,266 million at the end of the quarter (compared to €2,457 million in 9M 2021).

The future of mobility: electric vehicle & innovation

The future of mobility: electric vehicle & innovation

As electrification trends accelerate, Gestamp continues to work with its clients in this transition to be the leading player in the future of Electric Vehicle. In this line, Gestamp continues to focus on the development of projects that help its clients accelerate this transition, such as battery box and extreme size parts.

Gestamp provides solutions that make mobility cleaner and safer by adding new products to its portfolio and covering our clients EV needs. Thus, the recent resolution of the Ministry of Industry regarding the PERTE for the development of the Electric and Connected Vehicle (PERTE VEC) representing a boost for the Spanish automotive industry to develop impact projects that promote the electric vehicle. In this resolution Gestamp is present in 3 out of the 5 projects led by the OEMS.

Continued development in ESG

The Company is constantly working on achieving those sustainability goals that are part of its DNA focusing on a “greener” automotive industry and creating awareness of the importance of circular economy.

The Company is working to increase the sustainable origin and efficient use of the energy required for its production. In Brazil, Gestamp has just signed an agreement with Cemig to supply its electricity at the plants from renewable energy sources. The agreement will ensure that from 2024 all the plants and R&D center in Brazil will work with 100% renewable energy and will propell the company ahead sustainable operations as the Gestamp becomes the first automotive components company in Brazil to operate with electricity generated in a completely renewable way. With this new contract in Brazil, the company expands an ongoing strategy that started in Spain with its agreement with Naturgy, aiming towards the decarbonization of all its activities.

Market forecasts

According to IHS data, vehicle production is estimated to reach 81.8 million at the end of 2022, which would stand the market production 6 p.p. above FY 2021. This entitles a slowdown during the last quarter of the year.

The increase in energy costs, the rise in interest rates and high inflation contribute to maintain the context of macroeconomic volatility in the short and medium term.

The Company reiterates its guidance of 12.5 – 13% EBITDA Margin (including an additional 150 to 200 bps impact from Raw Materials) and a Free Cash Flow beyond €200 million, supported on preserving profitability and FCF generation.