Gestamp, a multinational specialized in the design, development and manufacture of highly engineered metal components for the automotive industry, today presented its annual results for 2021. The results are another example that the efficiency and flexibility measures implemented since 2020 have managed to consolidate the Company at profitability levels higher than pre-pandemic (2019) levels, despite the lower market volumes and the instability in production due to supply shortages seen during the year.

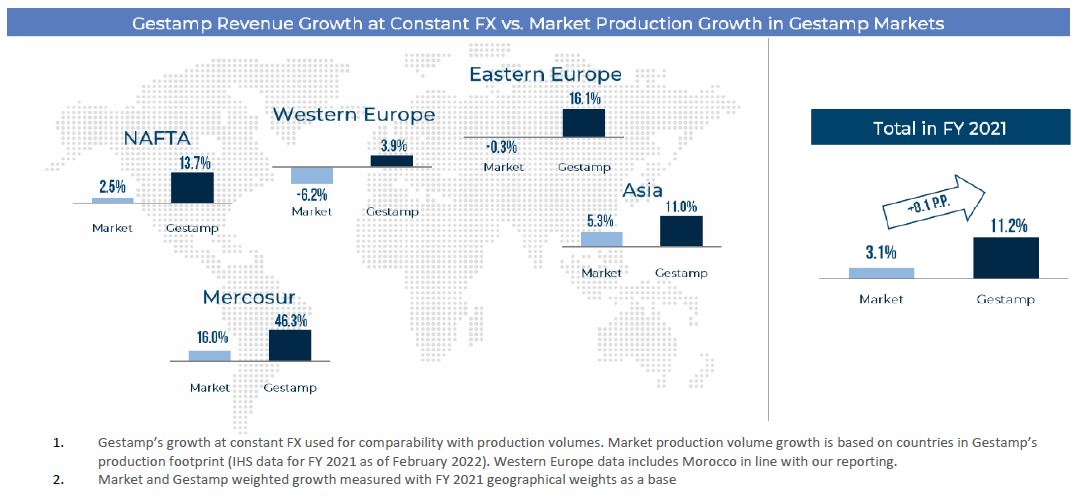

Gestamp's revenues increased by 11.2% at constant exchange rates (8.5% in reported terms) during the year, outperforming the global vehicle production market by 11.8 pp, on a weighted basis (8.1 pp in reported terms). The company managed to outperform the market in all regions where it operates, exceeding its target of outperforming mid-single-digit market volume growth.

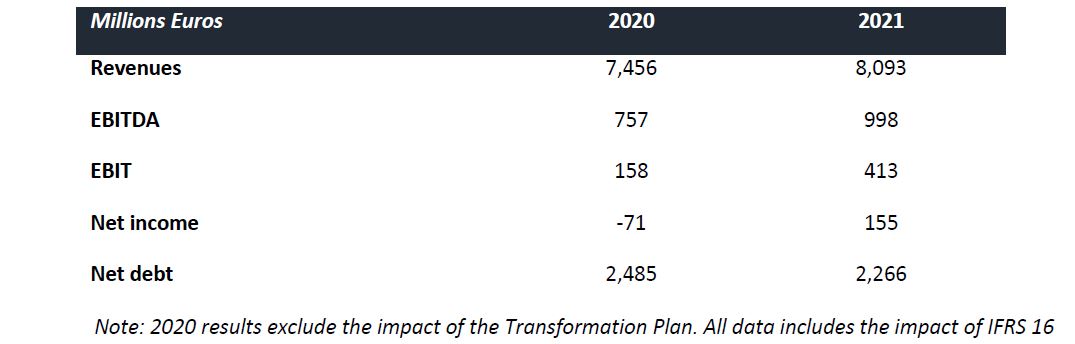

Gestamp's EBITDA reached 998 million euros in the same period, which represents an increase of 31.7% (36.7% at constant exchange rate) compared to the previous year). In terms of profitability, the EBITDA margin stood at 12.3% for 2021, compared to 10.2% in 2020 and in line with the Company's objective of exceeding 12%. These improvements are the result of the Company's rapid action to face the complicated market context, including the fixed cost reduction and flexibility measures implemented in our Transformation Plan, as well as the operational stability achieved at the plants.

Gestamp obtained a net profit of 155 million euros during 2021, which represents a significant improvement compared to the -71 million euros registered in the previous year (affected by COVID-19). Net profit stood at 55 million euros in Q4, positively impacted by the evolution of EBITDA and the solid financial discipline of the Company. This net profit will allow the to pay a dividend equivalent to 30% of its net profit, in line with the policy established since its IPO.

Capital expenditures stood at levels of 6.5% of revenues in 2021, or €531 million in absolute terms, in line with the Group's commitment to be selective and moderate investments in a volatile market environment. The Company continues to strengthen its position in electric vehicles and has allocated more than 40% of its investments for the year to this segment, with 30% of this focused on battery boxes.

The Group continues to focus on reducing net debt and deleveraging the business. For the second consecutive year, the Company has had a solid cash generation thanks to the financial discipline maintained. In the last twelve months, cash generation amounted to 248 million euros. Thus, net debt has been reduced to reaching 2,266 million euros, which places the leverage ratio at 2.3x, improving from 3.3x in December 2020. These are very comfortable levels of debt, reaching the objective marked for the medium term.

Resilience and adaptation

Gestamp obtains these results in a year 2021 that has continued to present significant challenges for the automotive sector. The semiconductor crisis has generated instability in production schemes, while the new variants of Covid-19 continue to impact global production. Production volumes in 2021 were almost 9% below initial forecasts at the beginning of the year, reaching 77.1 million vehicles, almost 12 million units below pre-pandemic levels in 2019.

In light of this market instability, Gestamp has been able to adapt to the different scenarios at all times. Agile decision-making focused on efficiency has enabled it to consolidate the improvement in profitability, despite the unfavorable market environment and growing inflationary pressures.

Forecasts and opportunities of the Group for 2022

During our Capital Markets Day in June 2021, we provided financial targets for 2022. Our targets were based on several key levers: i) market volumes similar to 2019, ii) fixed cost reduction, iii) operational stabilization, iv) industry 4.0 deployment in our factories and v) the implementation of ATENEA initiatives. Several of these key levers to reach our goals have changed significantly, mainly the automotive production volume environment, for which a more progressive recovery to pre-pandemic levels is expected throughout 2023, as well as the raw materials prices and cost inflation scenario, with unprecedented price increases.

To mainly reflect the increase in steel prices and inflationary pressures, Gestamp has adjusted its sales and EBITDA targets. The Company expects its revenue figure to continue to outperform market production volumes growth in the mid-single-digit range, measured at constant exchange rates, while rising steel prices will add an additional 10-15% of reported revenue growth. Our EBITDA in absolute terms is expected to grow between 13% and 15%, that is, between 130 and 150 million euros.

Capex and free cash flow targets remain unchanged. Regarding capex, Gestamp will continue to apply a policy of moderation, with the aim of reaching levels close to 7% of revenues. As for the generation of Free Cash Flow, it is expected to exceed 200 million euros, which will allow the Company to continue reducing its indebtedness and improving its financial profile.

Gestamp remains focused and working to meet its targets, as it has done consistently over the last three years.

Beyond our financial targets, Gestamp continues to focus on capturing new market opportunities. The transition to electric vehicles is gaining momentum. Electric vehicles are estimated to represent 35% of total light vehicle production in 2028, compared to the estimated 28% in June 2021. In this scenario, Gestamp's technological experience in adapting traditional products to the needs of electric vehicles, the development of new content around battery boxes, the entry of new purely electric manufacturers and the new needs for outsourcing components manufacturing are some of the opportunities offered by this market in transition.

Sustainability in the DNA of the Company

Environmental, social and governance (ESG) criteria have been in Gestamp's DNA since its foundation. Sustainability and the fight against climate change is intrinsic to its strategy. From the beginning, the Company has dedicated itself to the responsible manufacturing of lighter metal components for vehicles and thereby contributing to reducing CO2 emissions so that the environmental impact is reduced, always optimizing the use of natural resources and committed to the circular economy model.

The Company has received the Zero Waste certification granted by AENOR. Gestamp has become the first company in the automotive sector to achieve this, which is a recognition for the organisation, as it highlights Gestamp's Circular Economy model, which is capable of reintroducing the waste it generates back into the value chain. In regards to energy efficiency, Gestamp has signed a framework contract for the purchase and sale of on-site photovoltaic energy with POWEN, which means that the solar panels will be installed on the facilities’ roofs to allow energy self-consumption. Specifically, the agreement includes the installation and maintenance of POWEN photovoltaic panels for self-consumption in 20 production plants in Spain and 2 in Portugal, and the sale of the energy produced by the panels.

Along with these measures, the company has introduced the "ESG Academy", an online ESG training platform that will educate employees on the company's ESG goals and purposes.