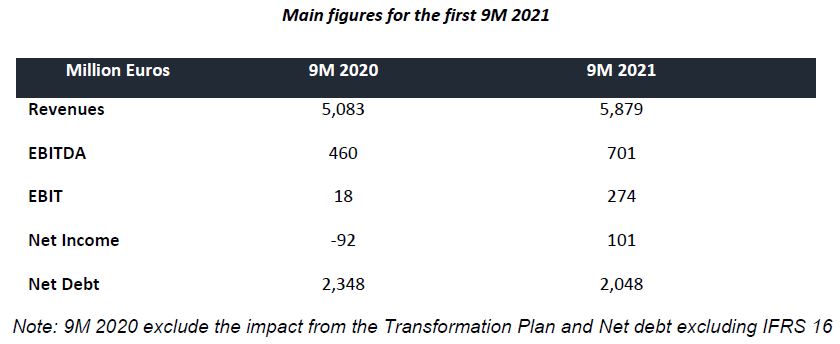

Gestamp, the multinational company specialized in the design, development and manufacture of highly engineered metal components for the automotive industry, presented its results today for the first nine months of 2021 with revenues reaching €5,879m and a net income of €101m despite challenging market conditions.

Gestamp's revenues increased by 19.5% at constant FX (15.6% in reported terms) in the first nine months of the year, outperforming the global vehicle production market by 11.5 p.p, on a weighted basis (10.0 p.p. in reported terms). The Company managed to outperform the market in all regions where it operates.

Gestamp's EBITDA reached €701m in the same period, up 52.3% (58.3% at constant FX) when compared to the same period of the previous year). In terms of profitability, EBITDA margin came in at 11.9% for the first nine months of 2021, compared to 9.1% in the same period of 2020. EBITDA margin in 9M 2021 is higher than the 11.5% obtained in the first nine months of 2019, despite experiencing a revenue decrease of €694m. These improvements are the result of the cost reduction measures from the Transformation Plan and the operational stability achieved at the Company's production plants.

Gestamp reported a net income of €101m during 9M 2021, a significant improvement when compared to the €-92m recorded in the same period of 2020, impacted by COVID 19. Net income during 9M 2021 has been driven by lower financial expenses, higher control of foreign exchange variations but impacted by EBITDA margin evolution in a more volatile market environment, as well as by D&A; as volumes are significantly below our expected capacity utilization but which will contribute to our growth going forward.

Capex decreased from levels of 7.2% of revenues in 9M 2020 to around 5.7% of revenues in 9M 2021 (both excluding IFRS 16) in order to adapt to the current market situation.

The company continues focused on reducing Net Debt and deleveraging the business. Since 9M 2019 net debt has been reduced by €616m to €2,048m at 9M 2021 (excluding IFRS 16). In the first nine months of the year, Gestamp reduced its Net Debt by €10m (excluding IFRS 16), with effective working capital management and a sound financial discipline as key levers. Leverage ratio continued improving, decreasing from 3.1x Net Debt/EBITDA in December 2020 to 2.2x as of September 2021 (excl. IFRS 16).

Gestamp is committed to generating free cash flow. As a result of a more moderate investment profile and a sound financial discipline, it was able to generate €55m in the first nine months of 2021 (€36m in Q3 2021).

Gestamp achieves these results despite the high volatility in production volumes due to the shortages of semiconductors, which is expected to reduce global output in 2021 by 9 million vehicles (IHS as of October 22nd, 2021).

Gestamp reiterates its guidance for 2021

Gestamp is focused and committed to delivering on its announced targets for the year of outperforming the market by mid-single digit (at constant FX), achieving an EBITDA margin of >12%, maintaining a moderate capex profile of below 6.5% of sales (excluding IFRS 16) and reducing its Net Debt by >€100m vs. FY 2020 (excluding IFRS 16).

In addition, Gestamp remains committed to reducing its carbon footprint and has recently reported the signing of the first agreement in the automotive sector to purchase green steel from ArcelorMittal, in line with its target of reducing its Scope 3 emissions by 22% by 2030 and continued digitalization initiatives Francisco J. Riberas, Gestamp's Executive Chairman, states: "At Gestamp we remain committed to our objectives for 2021 and we have once again demonstrated ourability to grow above the market, even in a challenging and volatile context such as the current one that we are facing".

"We will continue to focus on preserving profitability, free cash flow generation and further net debt reduction”, he explained.