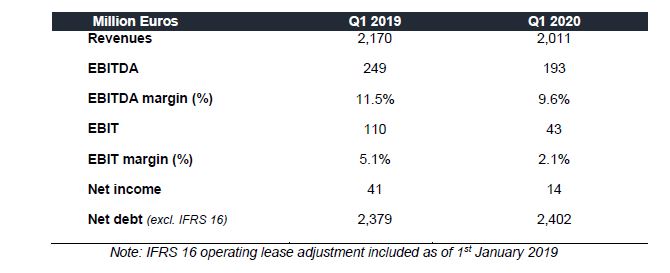

Gestamp, the multinational company specialized in the design, development and manufacture of metal components for the automotive industry, presented its results for the first three months of 2020 with revenues amounting to €2,011m despite the uncertain market environment as a result of the COVID-19 pandemic.

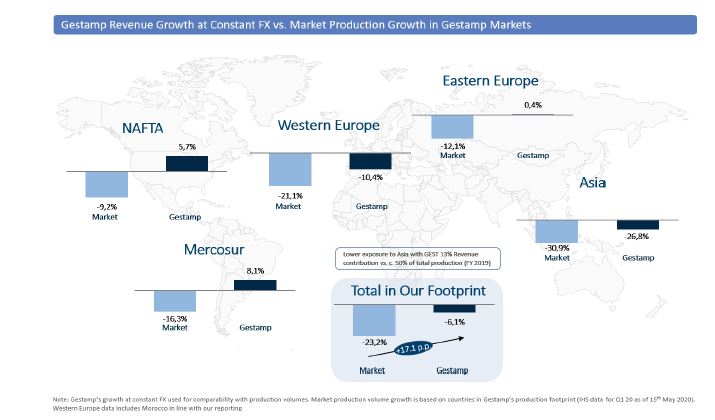

The reported revenue figure implies a -7.3% decrease (or -6.1% at constant FX) in a market that decreased by -23.2% during this period. The first quarter of 2020 has been impacted by the unprecedented challenge of the COVID-19 pandemic and Gestamp has been able to outperform the market as a result of new projects and lower exposure to Asia.

EBITDA reached €193m (-22.6% decrease compared to the first three months of 2019), reaching a 9.6% margin. The Company is focused on improving its cost flexibility structure to address the current situation. Net income reached €14m, impacted by the abrupt decrease in activity and limited lead-time to adjust the Company’s cost base as well as an increase in depreciations and amortizations as a result of high investments over recent years.

The challenging auto market has led to a downward revision of expected production volumes for the year 2020. In its latest forecast IHS foresees a -23% decline, this latest revision implies a gap of circa 19 million vehicles for 2020 vs. the February 2020 forecast.

“During Q1 2020 we have been able to manage the business fairly well despite the uncertain market environment as a result of the COVID-19 pandemic. Gestamp has been applying security protocols and will continue to do so to guarantee the safety of our employees and operations as we restart operations” Gestamp’s Executive Chairman, Francisco J. Riberas, explained.

“Gestamp is facing the COVID-19 crisis with a strong financial profile and enhancing its liquidity position and diversification of financial sources. We are implementing an action plan focused on cash preservation.” Riberas stated.

“The Company is working on a proactive assessment of the different scenarios in order to adapt its long-term oriented strategy to the changing market environment, always keeping our clients at the center of our business and focusing in the future.” he concluded.

Update by regions

Due to the COVID-19 the Group's facilities in all regions experienced a gradual closure, starting in China at the end of January, continuing to operations in Europe in mid-March and extending quickly to the Americas.

Some of the Group plants have resumed operations, including all Company’s facilities in China, and a gradual re-opening of the rest of its facilities is expected during the coming weeks. Gestamp has a clearly defined action plan to gradually restart activity. It includes health and safety protocols as well as applying lessons learned from the experience in China to the global operations.

Despite the challenging environment, Gestamp outperformed the market in all its regions during the first quarter. During this period the market reduced volumes by -23.2% whereas our sales (adjusted FX) fell by -6.1%.

Action plan to address current volatile environment

Gestamp has executed a comprehensive set of measures to adapt to the current environment by enhancing its liquidity position, labor force flexibility, working capital management and drastic capex reduction policy focused on preserving cash generation. The Company has implemented actions to strengthen its liquidity position to circa €2.0bn and reduce capex by 27% when compared to Q1 2019.

Furthermore, as the Company announced to the market and due to the current circumstances, Gestamp cancelled the payment of the supplementary dividend foreseen for next July (additional to the one paid last January).

In addition to the aforementioned measures and given the extraordinary nature of the situation Gestamp’s Top Management and Board of Directors have voluntarily reduced their remuneration.