Gestamp, the multinational company specialized in the design, development and manufacture of highly engineered metal components for the automotive industry, has presented its results for Q2 and H1 2020 in which the company reacted quickly to an unprecedented crash in the market due to COVID-19 and has demonstrated its flexible and resilient business model.

Specifically, Q2 2020 has been the toughest period for the automotive sector as well as the global economy in the last 75 years with a drop in global light vehicles production volumes of -45%. During Q2 2020 and despite the decline in activity, Gestamp’s revenues amounted to €1,034m and EBITDA €23m.

The company has experienced two challenging months during Q2, April and May, due to the shock in production in most of the geographies due to the COVID-19 pandemic. Activity levels have plummeted during Q2 in practically all our plants.

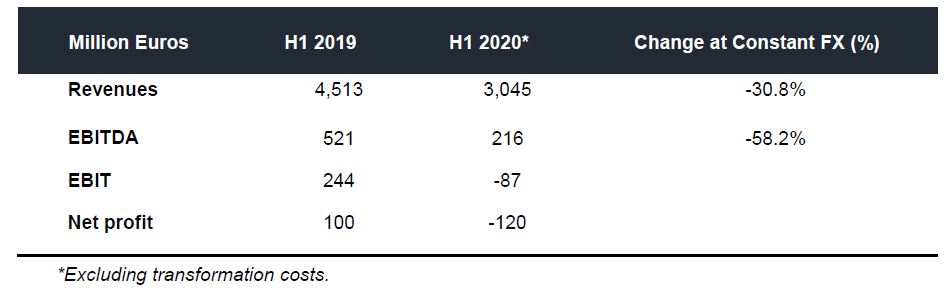

Gestamp reported revenues and EBITDA for H1 2020 of €3,045m and €216m, respectively. Net income reached -€120m. During this period, Gestamp business model has proven to be resilient and flexible, by adjusting its cost base by €351m in H1 2020 vs H1 2019 and improving its operating leverage level to 19% in Q2.

All in all, these measures have been balanced with a focus on protecting our people, contributing to society and serving our customers. In addition, Gestamp has made a significant effort to enhance financial flexibility including working capital management and strict capex control resulting in higher liquidity levels when compared to end of 2019.

In line with market analysts, activity levels are expected to improve in H2 as we are already experiencing during July in our plants. Nevertheless, Gestamp will maintain flexibility of its operational costs throughout the year to mitigate the drop in activity.

Gestamp‘s Transformation Plan

The Company will convey a transformation plan to adapt its cost structure and consolidate operational efficiency after a high investment period, preparing for the years to come in which auto market volumes will not recover 2019 levels until 2024, according to latest IHS forecasts.

The Transformation plan aims to increase the Group’s efficiency by absorbing the drop in sales and improving EBITDA margin significantly by 2022 with an estimated cost of €103m of which €90m is cash and €13m non-cash impact.

Amongst other actions, this plan includes labor force adjustment in Western Europe and America to adapt to lower volumes with a rationalization and consolidation of UK’s footprint with announced plant closures and labor expenses reduction in Germany. Tooling capacity to be reduced given market outlook and Corporate Headquarters cost structure will be slimmed down.

Gestamp’s Executive Chairman, Francisco J. Riberas, stated: “We reacted to the decline in revenues and were able to prove our flexibility and resilience. Gestamp has consistently maintained a high growth sales trend accompanying a growing auto market. The current scenario is different, and we need to adapt our cost structure and consolidate our operations after a high investment and growth period. We are a long term player”.

“Gestamp has maintained its continuous communication with all clients throughout the pandemic and will preserve this strategic relationship which remains intact as we have received important new nominations during this time period. We will keep focusing on continuing our efforts to offer solutions for the growing Electric Vehicle market and other CASE trends,” Riberas added.