Gestamp, the multinational specialized in the design, development, and manufacture of highly engineered metal components for the automotive industry, presented today its results for the first nine months of 2023. The financial figures recorded during the period remain in line with the objectives set by the company, as a result of the positive performance of the projects developed in an inflationary environment. Despite this situation, Gestamp confirms its guidance for year-end 2023.

Francisco J. Riberas, Executive Chairman of Gestamp: “The results for the first nine months of the year highlight the strength of our business model. We have once again achieved significant growth in our main financial indicators, highlighting our strong positioning, business discipline, as well as a constant focus on operational excellence. In addition, this growth was achieved while preserving our financial strength and investing in projects that will generate future value for our shareholders and the rest of our stakeholders”.

Achievement of financial targets

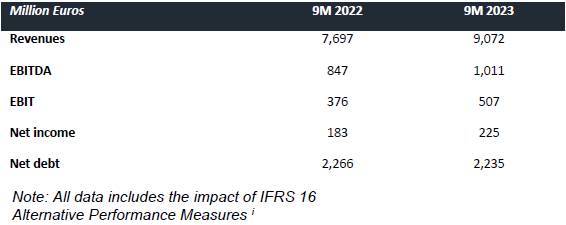

The strong market performance and a robust business model have made Gestamp achieve a solid financial result for the period. Despite the extraordinary negative foreign exchange impact of €384 million, the company increased its revenues by 18% year-on-year. This performance was mainly driven by the organic growth of the business, which reinforces a strong positioning in the market.

Gestamp’s revenues for the period grew by 18% reaching €9,072 million due to the company's organic growth. Once again, Gestamp outperformed the market by 8.9 percentage points (at FX constant and excluding the impact of raw materials). This growth is explained by geographic diversification, strong market positioning, and a strategy based on technology and innovation to support customers in achieving their objectives.

All this in a context in which 2023 is proving to be an exceptional year for the automotive industry. Throughout the period, the automotive market has registered a growth of 9.4%, reaching production volumes of 59.7 million vehicles per year, almost reaching pre-pandemic levels for the period.

EBITDA between January and September amounted to €1,011 million, a year-on-year increase of 19.3%, with an EBITDA Margin of 12.3% (excluding the impact of raw materials) despite inflationary pressures. Reported EBIT for the period was €507 million, which represents an increase of 34.8% over the same period of the previous year.

Net profit for the first nine months of the year reached €225 million, a year-on-year increase of 23%. This is the highest net profit during the first nine-month of a year in Gestamp’s listed history. These results demonstrate the strong commitment of the company to improve net profit.

Furthermore, investment levels between January and September amounted to €649 million, allocating 7.2% of its revenues to investments, in line with the target set for the year of 7.5%.

Minimum leverage level

Gestamp has reduced net debt to €2,235 million compared to 9M 2022, thus maintaining the leverage level at 1.6x net debt to EBITDA, getting closer to the target of 1.0-1.5x net debt to EBITDA set out in the 2023-2027 Strategic Plan.

As a result of this financial discipline, cash generation for the period (FCF) amounted to €80 million, aligned with forecasts and allowing the company to reaffirm its guidance of €200 million for the end of the year. Gestamp has a solid liquidity position of €1,914 million, which enables the company to meet its obligations in the coming years.

The results obtained by Gestamp in the first nine months of the year show that the company has a robust business model able to cope with the challenges of a volatile market while maintaining financial soundness. Gestamp continues to make progress towards meeting the goals established in its 2023-2027 Strategic Plan, with the aim of increasing the generation of value for all its stakeholders.

New milestones on the road to decarbonization

In line with the 2023-2027 Strategic Plan, Gestamp continues to advance on the path towards industrial decarbonization. Throughout the last quarter, the company has completed new milestones that have a significant impact on the construction of a business model in which the circular economy is transversal.

On the one hand, the company has agreed with Tata Steel to nearly double the percentage of recycled steel in components supplied to the automotive sector. The agreement with the largest steelmaker in the United Kingdom is a boost to increase the circularity of steel in the supply chain. In addition, Gestamp and SSAB have recently signed an agreement with the Swedish steelmaker to supply the Spanish multinational with SSAB Fossil-free™ (fossil-free steel), which will be used in the production of body-in-white and chassis products.

Both agreements are in addition to other alliances signed in 2023 that are focused on driving circularity throughout the business model to decarbonize its processes and contribute to the energy transition of the entire automotive supply chain.

Market forecast

Throughout 2023, the automotive market has continued to recover pre-pandemic production levels, although still below that threshold. Europe and Asia, driven by China, have been the most dynamic markets during 2023, raising the estimates made by experts at the beginning of the year.

According to forecasts, 2023 is expected to close with an increase in vehicle production of around 7.5%, a level that would almost double the initial growth estimate. In the medium term, several levers, including inflation, may impact market growth, so uncertainty will continue to be significant.

Despite these circumstances, the transition to electric vehicles remains the main lever for long-term growth, and, in this regard, Gestamp has a project to lead this transformation. The company is developing a strategy around technological innovation and operational excellence that will enable it to drive profitable growth at a time of deep change for the automotive industry as it faces the challenges of electrification and decarbonization. With its value proposal, Gestamp is working to become the partner supplier in the transition to sustainable mobility.

[i] Alternative Performance Measures

This press release (the "Press Release"), in addition to financial information detailed in the Gestamp Group´s financial statements prepared in accordance with International Financial Reporting Standards, contains alternative performance measures ("APMs") as defined in the Guidelines on Alternative Performance Measures published by the European Securities and Markets Authority (ESMA) on October 5, 2015.

A breakdown of the explanations, definitions and reconciliations of the APMs used in the Press Release can be found, as applicable, in Note 4.6. of the Notes to the Consolidated Financial Statements of the Gestamp Group as of December 31, 2022, in the Management Report for the nine months period ended 30 September 2023, as well as in the relevant results presentation, available both on Gestamp's corporate website (https://gestamp.com/Investors-Shareholders/Economic-Financial-information) and on the website of the National Securities Market Commission (Comisión Nacional del Mercado de Valores) (www.cnmv.es).